Spring 2025 Check-in

Late last summer we put together a report rounding up national housing market forecasts for the Fall and end of 2024. Now, several months later, we’re checking back in to see how the national housing market has evolved, with a focus on key areas: mortgage rates, inventory, and prices.

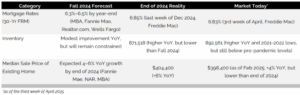

The following table summarizes how the Fall forecasts materialized by the end of 2024 and where the market stands today:

Mortgage rates continued to remain elevated through the end of 2024 and as of mid-April stand at 6.83%. While this is below recent peaks north of 7%, including in April of last year, recent trade and financial markets volatility has placed an upward pressure on rates.

On the supply side, inventory has expanded since the start of the year as well as Spring of last year; however, it remains well below pre-pandemic levels which largely averaged north of one million active listings each month. The “lock-in” effect, whereby existing homeowners are unwilling to sell and give up their sub-3% pandemic-era mortgages, continues to constrain resale inventory. Meanwhile new construction inventory has not yet filled the supply shortage, especially as builders continue to face rising costs for materials and labor as well as regulatory/zoning hurdles.

Looking at price trends, analysts expected to see continued appreciation, which has been observed in the market. Even with elevated rates, low supply has continued to exert upward pressure on prices, although we’re seeing a slower pace of growth.

Nevertheless, affordability continues to worsen in many markets, as price gains have far outpaced income growth and rate relief has yet to arrive.

Looking ahead to the second half of the year, the key variables to watch will be whether economic conditions improve enough to bring down bond yields—and, in turn, mortgage rates—whether housing starts can gain meaningful traction despite ongoing regulatory and cost barriers, and whether the cumulative strain of affordability begins to weigh more heavily on home prices.

While last fall’s forecasts leaned cautiously optimistic, the Spring 2025 check-in suggests that many of the same challenges remain firmly in place.

Sources: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; Realtor.com, Housing Inventory: Active Listing Count in the United States [ACTLISCOUUS], retrieved from FRED, Federal Reserve Bank of St. Louis; National Association of Realtors, Median Sales Price of Existing Homes [HOSMEDUSM052N], retrieved from FRED, Federal Reserve Bank of St. Louis

Fall 2024 Forecasts

Autumn has traditionally provided a seasonal boost for the housing market in many cities relative to slower late summer months. While not as busy as the seasonal peak in spring and early summer, fall sees a return from summer holidays, schools starting, and the holidays fast approaching, with many buyers choosing to embark on their homebuying journey during these months.

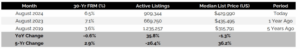

While seasonality plays a role in the housing market, the degree and direction can vary year-to-year and city-to-city. Nevertheless, the driving factors influencing the housing market across the country remain high relative mortgage rates, low inventory, and inflation. The table below details the year-over-year and five-year (pre-pandemic versus now) change in the 30-year fixed rate mortgage, active home listings, and median list price.

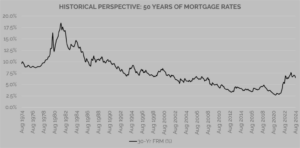

Mortgage Rates

The 30-year fixed rate mortgage closed out August averaging 6.5% with the most recent weekly rate (as of the first week of September) at 6.35%. While rates have come down since last Fall, they remain significantly higher relative to recent years.

The rapid increase in rates since 2022 has contributed to reluctance from many would be buyers and home sellers. On the sell-side, the reluctance can be attributed to the much discussed ‘lock-in-effect’ whereby would-be sellers who locked in ultra-low mortgage rates forego listing their homes and buying new ones at higher rates. On the buy-side, higher monthly payments constrain the budgets of many buyers who may wait on the sidelines hoping for future rates to fall. Eventually, as this new normal of higher relative rates (over 5%) sets in, the reluctance by both parties will subside.

Looking ahead, many analysts are cautiously optimistic about rate cuts through the end of the year. Although mortgage rates are not directly correlated with Federal Reserve policy—they are more directly tied to ten-year treasury yields—they can be influenced by how investors believe monetary policy moves will impact the broader economy.

The table below summarizes year-end forecasts for the thirty-year fixed rate mortgage by various institutions.

Housing Inventory

The supply of housing remains low across the country, despite an uptick from a year ago. The number of active listings in August was 35.8% higher than a year ago, but 26.4% lower than pre-pandemic levels in August 2019.

In addition to the lock-in-effect, factors contributing to low housing supply include:

- Limited new home construction as a result of rising material and labor costs as well as regulatory and zoning restrictions

- Backlog from pandemic-related disruptions to supply chain, labor shortages, and restrictions on projects

- Investor and institutional purchases of homes in high-demand markets reducing the stock for traditional buyers (particularly non-cash)

- Aging housing stock—homeowners may be reluctant or unincentivized to list homes that require significant renovations

- Demographic shifts: Millennials and the oldest in Gen-Z have reached home-buying age, increasing demand and exacerbating low inventory conditions

While the real estate industry and adjacent institutions do not forecast inventory levels in the same way they do mortgage rates, the general consensus suggest that supply will remain constrained through the end of the year, despite some improvements compared to a year ago. The long term view is that until structural issues, such as new home construction, are addressed, inventory levels will likely remain low.

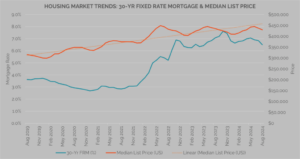

Home Prices

Low inventory has only helped fuel home price appreciation in recent years, despite rising mortgage rates, compounding affordability constraints in many markets. Although the median list price for homes in August was slightly lower than a year ago, the overall trend over the last five years has been upwards.

Looking ahead, home prices are expected to close out the year 4-6% higher than the previous year. The table below summarizes year-over-year home price appreciation forecasts by Fannie Mae, NAR, and MBA.

Sources: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; Realtor.com, Housing Inventory: Median Listing Price in the United States [MEDLISPRIUS], retrieved from FRED, Federal Reserve Bank of St. Louis; Realtor.com, Housing Inventory: Active Listing Count in the United States [ACTLISCOUUS], retrieved from FRED, Federal Reserve Bank of St. Louis; Fannie Mae Economic & Strategic Research: ‘Housing Forecast August 2024’

Mortgage Bankers Association ‘Economic and Housing Market Outlook (as of June 2024)’ and ‘MBA Mortgage Finance Forecast (08.15.2024); Other: US News, National Association of Realtors, Norada Real Estate Investments

Get more real estate trends that impact your business today from The Kennelly Group.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.